- -Able to understand basic cost concepts and financial reports

-

Basic Financials

Click on the Play button to start the introduction video.

-

Show Me!

Show Me!

Interviews: Financial AdviceClick on the Play button to start the video.

What financial information should you have knowledge of?

- Food costing

- Operational costs

What skills are key to good financial management?

- Cost control

- Wastage

- Understanding profit

What sort of records do you need to keep?

- Receipts and invoices

- Wage documents

- Incomings and outgoings - recorded in spreadsheet or MYOB

You must have a good filing system.

What advice would you give to someone opening a hospitality business?

You must have a business plan:

- what the business looks like

- cash flow

- costs - set up, advertising, employment, stock

- projected incomes

- pay bills, pay borrowed money

- availability of money to use

- show that you have the experience to run the business

Show Me!

food and beverage cost cost of purchasing ingredients to make dishes and drinks rack cost base cost of an accommodation room cost of goods base cost of anything that is not food or beverage, eg a souvenir overheads (general expenses) all the outgoing expenses linked to a business, such as rent, power, materials, equipment, maintenance and repairs labour cost monies paid in wages for work done by employees balance sheet a financial overview of the business that summarises what they own and what they owe at a particular moment in time profit and loss statement a statement that shows the profit (money that has been made) and/or loss for a given time period gross profit gross profit = income minus food and beverage costs net profit net profit = income minus food and beverage costs and overheads GST (goods & services tax) a tax charged on all goods and services within a business and then paid to the taxation office income (sales or revenue) money that is generated by a business, eg by selling food and beverages, or for providing accommodation fees and charges additional costs attached to a booking or for providing a service or product Show Me!

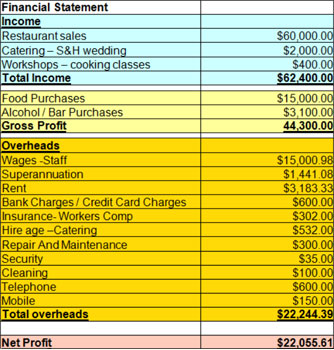

Financial StatementsClick on the Play button to start the video.

Financial statements are like the report card of a business.

Being able to understand financial statements will tell you:

- how much money there is

- how much money is owed

- income

- expenses

A financial statement is made up of four main areas:

- income

- gross profit

- overheads

- net profit

Gross Profit = total income (or sales) minus Food/Beverage costs

- helps you know how much money you have spent on food

- this should not be more than 30%

Net Profit = gross Profit minus total overheads

- this gives an understanding of how much money you have made

-

Say It

There are 2 parts in this section.

1. The GlossaryThe glossary lists the more difficult words related to the topic in alphabetical order. The glossary also gives the meaning for each word.

2. Look, Cover, Write, Check!This activity gives you practice at remembering and writing the words from the glossary.

The Glossary

-

Do It: Basic Financials

Jump to Activities

Jump to Activities

Do It: Basic Cost Terms and Concepts

food and beverage cost cost of purchasing ingredients to make dishes and drinks labour cost monies paid in wages for work done by employees balance sheet a financial overview of the business that summarises what they own and what they owe at a particular moment in time profit and loss statement a statement that shows the profit (money that has been made) and/or loss for a given time period gross profit gross profit = income minus food and beverage costs net profit net profit = income minus food and beverage costs and overheads GST (goods & services tax) a tax charged on all goods and services within a business and then paid to the taxation office income (sales or revenue) money that is generated by a business, eg by selling food and beverages, or for providing accommodation Within the hospitality industry, there are a range of terms you will need to be familiar with when measuring costs. We will focus on a few of the basic ones in this activity.

Let's have a look at the terminology table which highlights these important terms and their definitions. Read the information carefully.

Do It: Finding out the Cost

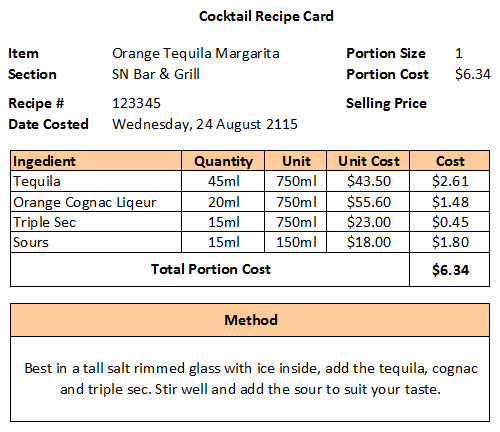

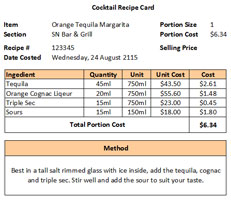

Below is a Standard Recipe Card with the ingredients listed for an Orange Tequila Margarita cocktail.

Double-click on the image to view a larger version.

Double-click on the image to view a larger version.Do It: Financial Statements: Net Profit and Gross Profit

Financial statements are like the report card of a business. In order to keep track of the finances in any business, you need to understand how to read them.

Check It

Check It QuizBasic FinancialsClick on Basic Financials to begin.

Additional Resources:

B52 SRC Watermelon Mai Tai SRC Blue Lagoon SRC Open Calculator

- Introduction

- Show Me

- Say It

- Do It

- Check It