- -Able to complete sale transactions using a float and end of shift reconciliation.

-

Balancing Registers

Click on the Play button to start the introduction video.

-

Show Me!

Show Me!

It is important to know and understand the procedures for opening a point of sale (POS) area correctly. You will need to know how to prepare the float.

The float:

- is the amount of money that is in the till at the beginning of a day's trading.

- allows the business to give change from the moment business begins.

The size of the float will depend on the kind of business and how busy it is at the beginning of the business day.

Notes and coins of different amounts are described as denominations of cash.

Notes come in 5 denominations:

- $100

- $50

- $20

- $10

- $5

The quantity of notes and coins needed in a cash float:

- varies between workplaces.

- may vary between busy days and quieter days.

When opening a point of sale (POS) you may need to record the different amounts and denominations used to make up the float on a Cash Float Record Sheet. This form shows the notes and coins, or denominations, the numbers of that denomination and the total amount.

To work out the amount for notes:

Amount = notes x number, eg $5 x 2 = $10.

To work out the amount for coins:

Amount = coins x number, eg 50c x 7 = $3.50

When all denominations are recorded, add up the subtotal of notes and coins, and then enter the total of the float. You are now ready to start your shift.

Show Me!

Closing a Payment PointClick on the Play button to start the video.

At the end of the working day you close the payment point.

- A reading is taken of the business transacted.

- Cash and other payments are counted.

- The float is counted.

- Everything is handed over to the authorised personnel.

A procedure should be followed when closing a payment point.

- Remove all cash and non-cash transactions from the register.

- Separate the float from the rest of the cash.

- Count the cash and calculate the non-cash receipts accurately.

- Record the store takings on to a counting sheet.

- Check the balance between the register and calculated sum that you recorded.

Different establishments have different ways of handling the float at the end of the day.

Remember: Cash transactions are the notes and coins. Non-cash transactions are those where credit cards, debit cards, cheques and vouchers have been used for payment.

-

Say It

There are 2 parts in this section.

1. The GlossaryThe glossary lists the more difficult words related to the topic in alphabetical order. The glossary also gives the meaning for each word.

2. Look, Cover, Write, Check!This activity gives you practice at remembering and writing the words from the glossary.

The Glossary

-

Do It: Balancing Registers

Different establishments follow different procedures for handing over the cash float at the opening of a shift to closing down the shift. In some establishments a manual is available to provide sales persons with the correct procedures to follow in processing cash and non-cash transactions. These procedures ensure that standards of accuracy and efficiency are maintained at all times.

As a food service employee, in addition to processing payments and receipts, your duties may include balancing your register or terminal at the end of the workday.

Jump to ActivitiesDo It: Opening a Shift

A well organised point of sale area allows efficient processing of client transactions. It is therefore important for you to know and understand the procedures for opening the point of sale area correctly. These procedures may vary from establishment to establishment.

One of the most important tasks in opening procedures is organising and preparing the float.

It is important that you understand your workplace set up of the standard float as it varies across different workplaces. It is crucial that at the closing of a shift, the float is the same amount as it was at the opening of the shift.

Notes and coins of different quantities are described as denominations of cash. For example, notes come in 5 denominations: $100.00, $50.00, $20.00, $10.00 and $5.00. A float is a set amount of money made up of a range of denominations of coins and notes and placed in the register at the beginning of the day or shift.

Do It: Closing a Payment Point

This takes place at the end of the working day. At this time a reading is taken of the business transacted during the day, cash and other payments are counted; the float is counted and handed over to the authorised personnel.

There is a general ordered procedure of steps that should be followed when closing a payment point. These include:

- Remove all cash and non-cash transactions from the register/terminal

- Separate the float from the rest of the cash in the register

- Count the cash and calculate the non-cash receipts accurately

- Record the store takings on to a counting sheet

- Check the balance between the register and calculated sum that you recorded.Different establishments have different ways of handling the float at the end of the day.

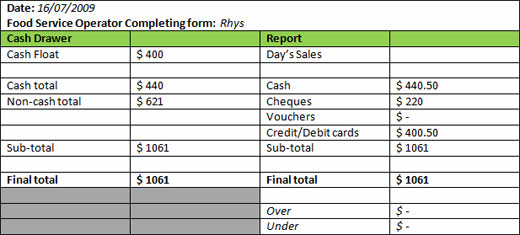

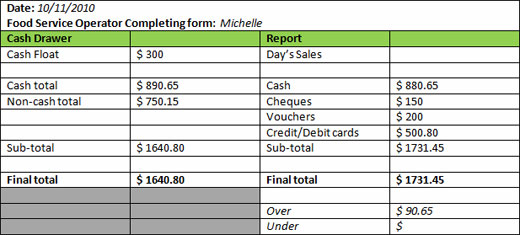

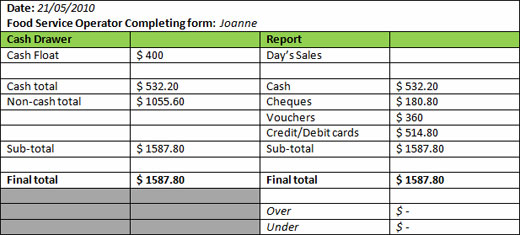

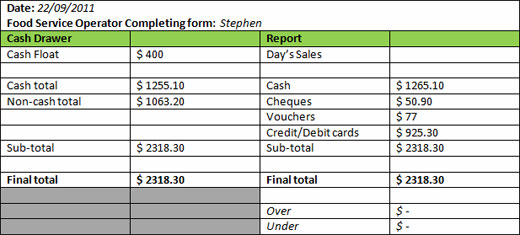

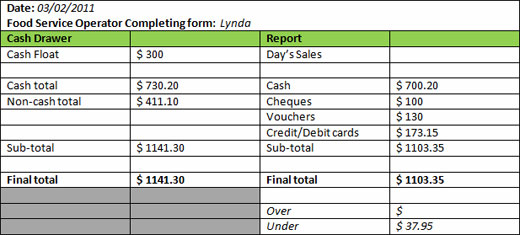

Do It: Balancing the Register

This is the point at which you will enter the information recorded on your counting sheet into the register. At this stage a report is generated.

The form below is a sample of a reconciliation form used to record the daily sales figures. It is important that you learn to complete these forms accurately.

Check It

Balancing Registers

- Introduction

- Show Me

- Say It

- Do It

- Check It