Student Outcome

- -Able to understand GST

- -Able to identify information that is related to tax invoices

- -Able to understand how to calculate GST

-

Understanding GST & Tax Invoices

Click on the Play button to start the introduction video.

-

Show Me

Show Me

GST and Tax InvoicesClick on the Play button to start the video.

- GST = Goods and Services Tax

- In Australia, GST was introduced in 2000

- GST rate is set at 10% in Australia

What is taxed?

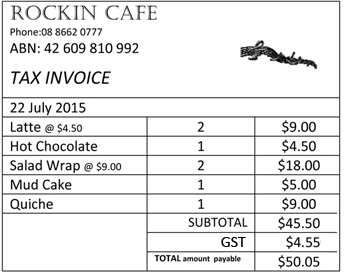

- Hospitality: Wine, beer, spirits, hot food

- Tourism: Accommodation, travel tours, souvenirs

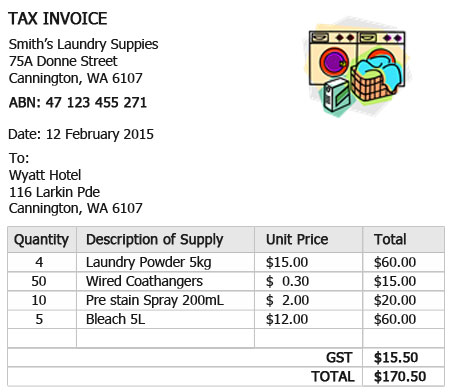

A Tax Invoice has required information:

- Name of Supplier

- ABN of Supplier

- Name of Purchaser(Customer)

- Address or ABN of Purchaser

- Date of Issue

- Words "Tax Invoice" on the document

- GST and Total price OR

- GST inclusive price

- Brief Description of items

- Quantity of things supplied or service

- Restaurants will usually list prices on the menu as GST inc = GST "inclusive".

- Tax invoices can list and calculate the GST in different ways.

Show Me

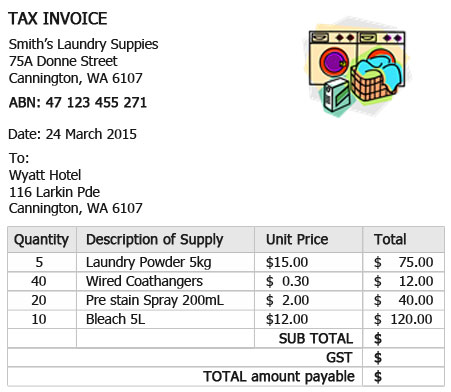

Calculating GST

To calculate the GST on the subtotal price of $700.00

- Change 10% into a decimal

10% = 0.10 - $700.00 needs to be multiplied by 0.10

- $700.00 x 0.10 = $70.00

- Add the GST of $70.00 to the subtotal.

- $700.00 + $70.00 = $770.00

- The total amount payable is $770.00

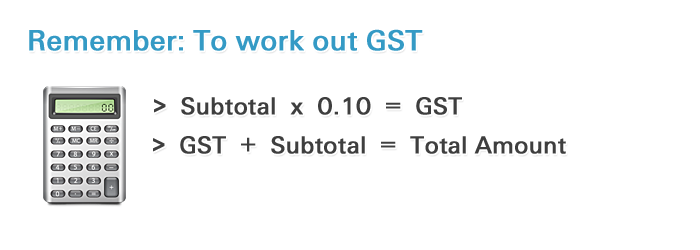

- Remember: To work out the GST:

Subtotal x 0.10 = GST

GST + subtotal = Total amount

- Change 10% into a decimal

-

Say It

There are 2 parts in this section.

1. The GlossaryThe glossary lists the more difficult words related to the topic in alphabetical order. The glossary also gives the meaning for each word.

2. Look, Cover, Write, Check!This activity gives you practice at remembering and writing the words from the glossary.

The Glossary

-

Do It

Jump to Activities

Jump to Activities

Do It: GST

Do It: Tax Invoices

Do It: Tax Invoice: Calculating GST

Check It

Understanding GST

- Introduction

- Show Me

- Say It

- Do It

- Check It